How to Improve Your After-fee and After-tax Returns

Every investor and financial advisor should pay attention to the costs of investing (advice fees, management fees and transaction fees). As with everything else, lower costs mean that there is less drag on investment performance. However, lower fees do not always lead to better results. Here’s why:

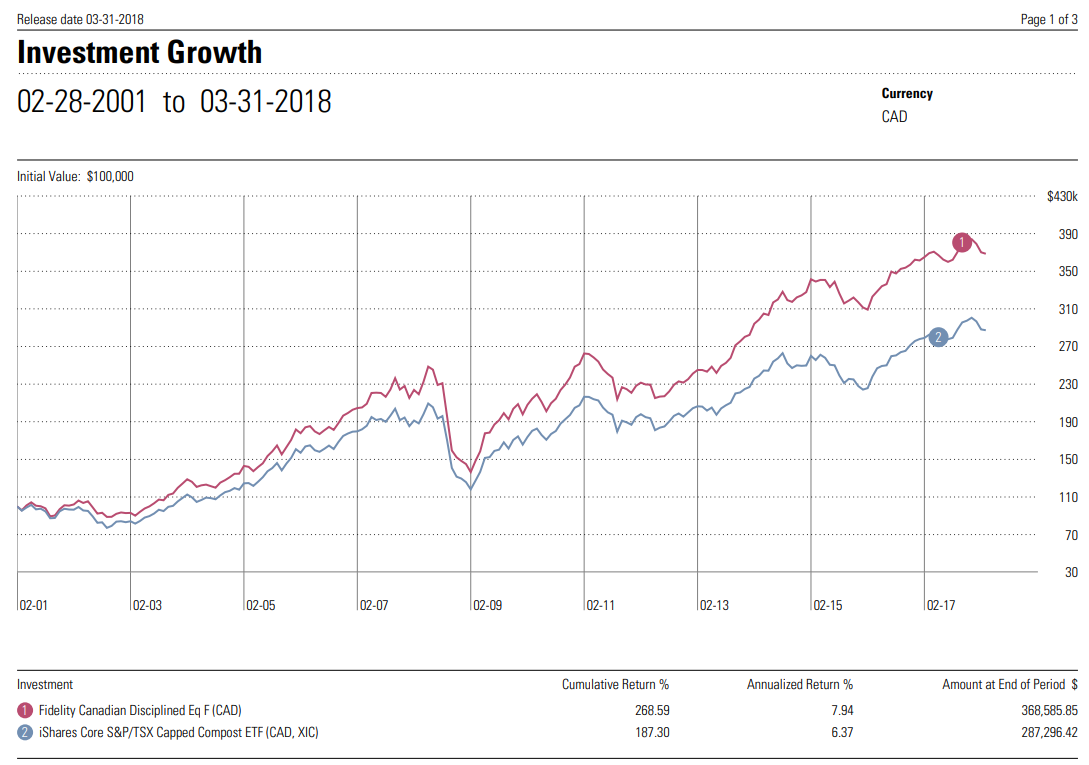

One investment manager may spend very little on research of funds, for example by passively buying every stock in the index, in the same proportions as the index. As this manager doesn’t expend any resources on making decisions or analyzing the stocks that go into the portfolio, he/she can afford to charge a very low management fee. In the ETF example below, the MER is only 0.06%, therefore the investors can expect to earn the same return as the S&P/TSX index, less just 0.06%.

Another fund may be managed by a team of analysts and managers, who analyze every aspect of a company: its management team, management style, competitive advantage, other companies in the same industry, its debt, return on equity and a hundred other facts and factors. The managers may visit the company regularly, talk to the company management, take apart the financial statements, look at their pension plan and stock option plans, management compensation, etc. If the managers are very good at what they do, they will avoid weak companies and have a higher weighting in stronger companies. This results in higher returns and justify the higher management fee that they charge.

In the example below, the Fidelity fund charges a MER of 1.1%, much higher than the low-fee ETF, at 0.06%. The after-fee returns, however, are much better for the actively managed Fidelity fund. The chart shows the returns after fees, for both investments. Would you choose the one with the lower management fee, or the one with the higher management fee?

Similarly, all investments are not equal with respect to taxes. Under our tax system, interest is taxed at the same rate as employment income, while capital gains are taxed at half the rate. Additionally, investments that defer tax, such as corporate class mutual funds, will compound more quickly if money is not taken out each year to pay CRA for the tax payable on gains.